WORD FROM WASHINGTON

After one year, Medicaid coverage losses during “unwinding” continue to surpass worst fears

According to the latest KFF Medicaid Unwinding Enrollment Tracker, more than 21 millionAmericans have lost Medicaid coverage during the first year after states were allowed to resume eligibility verifications following the COVID-19 public health emergency. There remains wide variation in disenrollment rates among states ranging from a high of 56 percent in Utah to only 12 percent in Maine.

Overall, states have only completed only two-thirds of all renewals. Although the Biden Administration granted states until the end of May to finish, several states including Arkansas, Oklahoma, and West Virginia rushed through the process in nine months or less. Not coincidentally, all three have some of the highest rates of net disenrollment (losing more than 20 percent of all Medicaid enrollees).

A new study from the Urban Institute found that states that rushed through the renewal process in under one year or failed to take advantage of waiver flexibilities offered by the Biden Administration (Florida and Montana applied for none) experienced the worst net coverage losses (more than 120 percent of projections).

At least 70 percent of Medicaid terminations continue to be for procedural reasons (such as not returning forms on time) and could still be otherwise Medicaid-eligible. Procedural termination rates vary even more widely than total disenrollment, with Nevada and Utah continuing to exceed 90 percent while Maine remains well below any other state at only 22 percent (California has improved from 90 percent earlier in the “unwinding” to 76 percent currently).

HFA remains focused on mitigating erroneous coverage losses as figures for both total disenrollments and procedural terminations far exceed initial projections by KFF, the Urban Institute (which estimated nearly 15 million would lose coverage), and the Congressional Budget Office. Heightening these concerns is the fact that nearly one-quarter of all Medicaid coverage losses have remained uninsured. However, KFF found that this share is much lower in states that expanded Medicaid under the ACA compared to the ten “opt-out states” (six percent compared to 17 percent).

Even more troubling is the revelation that 40 percent of coverage losses are among children (in states reporting age breakdowns), including more than one million in Texas and half a million in Florida. According to Georgetown University’s Center for Children and Families, eight states (MT, ID, SD, AR, NH, UT, AK, CO) disenrolled so many children in 2023 that they have fewer enrolled than prior to the pandemic (Montana’s child enrollment is already 15 percent lower than pre-pandemic figures).

A federal lawsuit against Florida Medicaid for inadequate notices of “unwinding” terminations has been certified as a “class-action” and scheduled to be heard on May 13th.

Administration finalizes series of regulations to expand access to care, limit insurer discrimination

Notice of Benefit and Payment Parameters

The Centers for Medicare and Medicaid Services (CMS) issued its final Notice of Benefit and Payment Parameters (NBPP) regulation for 2025 health plans. At the urging of HFA and hundreds of stakeholders, the agency agreed to effectively close the essential health benefit “loophole”, at least for individual and small group plans. Insurers (especially in the large-group/self-funded market regulated solely by the federal government) have been using this “loophole” to implement “copay maximizers” and go after the full manufacturer copay assistance available to consumers by declaring specialty drugs consumers need to be “non-essential” and not subject to ACA cost-sharing limits. CMS pledged to close the “loophole” for large group/self-funded coverage in future rulemaking.

Neither CMS nor the full Department of Health and Human Services (HHS) has yet to respond to a federal court decision last fall invaliding its controversial NBPP rule for 2021 that allowed plans to use copay accumulators and maximizers. In response to questions from the sponsor of Congressional legislation to ban such copay diversion tactics, the HHS Secretary made statements that reflected the agency’s alarming lack of understanding and/or awareness of the issue and its harmful impact on consumers. HFA continues to work with the All Copays Count Coalition and other stakeholders to urge HHS to prohibit all forms of copay accumulators/maximizers in the 2026 NBPP or earlier rulemaking.

ACA anti-discrimination protections

The HHS Office of Civil Rights (OCR) finalized long-awaited regulations for enforcement of Section 1557 of the ACA. The new non-discrimination rule prohibits discrimination in health programs and activities receiving federal financial assistance on the basis of race, sex, age, or disability. This includes Medicare, Medicaid, and the ACA health insurance Marketplaces.

According to OCR, the rule “restores protections gutted by the prior administration”, such as discrimination based on gender identity. It further reinstates protections against “discriminatory health insurance benefits designs by insurers” and for the first time extends those protections to short-term limited duration insurance (STLDI) and Medicare supplemental (i.e. Medigap) coverage.

While OCR fails to provide the specific examples of discrimination sought by HFA and other stakeholders, it does identify insurer practices that can be potentially discriminatory, including blanket coverage exclusions/benefit limits, restrictive prescription drug formularies, cost-sharing tiering (including copays, coinsurance and deductibles), and utilization management techniques (step therapy and prior authorization). OCR will conduct fact-specific inquiries into complaints of discrimination to see if health plans have a “legitimate non-discriminatory reason” for the practice.

Section 504 disability discrimination protections

HHS OCR simultaneously issued new regulations relating to enforcement of Section 504 of the Rehabilitation Act of 1973, the nation’s first law prohibiting discrimination based on disability.

The final rule called Discrimination on the Basis of Disability in Health and Human Service Programs or Activities is the most significant regulatory update in the history of Section 504. According to OCR, the rule aligns Section 504 with Americans with Disabilities Act (ADA) standards and “protect[s] people with disabilities from experiencing discrimination in any program or activity receiving funding from HHS.” It specifically clarifies that medical treatment decisions cannot be based on “negative biases or stereotypes about individuals with disabilities, judgments that an individual with a disability will be a burden on others, or dehumanizing beliefs that the life of an individual with a disability has less value than the life of a person without a disability.”

The rule also explicitly bans the use of “any measure, assessment or tool that discounts the value of a life extension on the basis of disability to deny, limit, or otherwise condition access to an aid, benefit or service”, in direct response to concerns from patient advocates that Quality Adjusted Life Years (QALYs) and other cost-effectiveness measures increasingly relied on by insurers inherently discriminate against persons with disabilities. (The Affordable Care Act already bars the use of QALYs in Medicare).

HHS received thousands of comments on the proposed rule last fall, including from the Bleeding Disorders Substance Use and Mental Health Access Coalition (of which HFA is a core member), which identified several examples of inpatient mental health or substance abuse facilities categorically excluding persons with bleeding disorders. In direct response, HHS reiterated that such “categorical judgments based on the presence of a specific diagnosis that do not entail an individualized assessment” of “whether a disability renders an individual not qualified for treatment” is likely to be unlawful discrimination under Section 504. BDSUMHAC and HFA will continue working with HHS OCR to ensure proper enforcement of this standard.

CMS opens Marketplace insurance to children of undocumented immigrants

CMS finalized regulations this week that will allow an estimated 100,000 Deferred Action for Childhood Arrivals (DACA) recipients to enroll in health insurance Marketplaces or Basic Health Plan program coverage created by the ACA, starting November 1st.

DACA recipients are individuals brought to the United States as children by undocumented parents. The DACA program has been beset by legal challenges since its creation in 2012 and is expected to be ultimately resolved by the U.S. Supreme Court next year.

According to KFF, individuals who meet DACA criteria are four times more likely to be uninsured than U.S. born individuals in their age group. As a result, CMS still weighing whether to finalize proposed regulations from 2023 that would allow DACA recipients to enroll in Medicaid and the Children’s Health Insurance Program (CHIP), which would greatly expand the number of eligible recipients.

STATE OF THE STATES

Work reporting requirement kills Medicaid expansion in Mississippi…for now

Efforts to reach an 11th hour compromise on Medicaid expansion legislation failed this week after a handful of Senate Republican lawmakers refused to budge on their demands that the final bill include a work reporting requirement that must first be approved by the federal government.

The House and Senate had passed competing Medicaid expansion bills last month by sufficient margins to override the promised veto from Governor Tate Reeves (R) (see State of the States, March 2024). However, unlike the House passed a full expansion under the ACA, the Senate offered only a partial expansion with a strict work reporting requirement that could not be removed.

While the Senate did eventually agree to the full expansion (to receive federal matching funds), several key Republican leaders were fervently opposed to dropping the work reporting requirement, preferring instead to wait for another year to see if a potential second Trump Administration would approve it.

The Biden Administration has consistently rejected work reporting requirements based on the experience of Arkansas, where a comparable requirement caused thousands of otherwise eligible enrollees to lose coverage when they did not promptly respond to requests to verify their job or school status. Multiple studies have shown that most Medicaid enrollees already work and the reporting requirements not only boot them off coverage for which they should be eligible but are very costly for states to implement.

Mississippi remains one of only ten states that continue to “opt-out” of the Medicaid expansion under the ACA.

Mississippi becomes 28th state with Rare Disease Advisory Council

Governor Tate Reeves (R) signed legislation this month making Mississippi the 28th state to create a Rare Disease Advisory Council (RDAC).

The measure (S.B. 2156) creates a group of patients, caregivers, providers, insurers, and drug manufacturers to educate policymakers about the “complex medical needs of those with rare diseases and make policy recommendations that improve rare disease patient access to critical health care services.”

Mississippi becomes the first state to enact RDAC legislation in 2024. Delaware, Indiana, and Maryland did so in 2023 (see State of the States, Fall 2023). Arizona, California, and Vermont are among the states pursuing similar bills this year.

Copay accumulator bills advance in two states, but momentum stalls in most others

The Assembly Health Committee in California unanimously approved legislation this month at would ensure consumers in state-regulated health plans have access to third-party assistance with their cost-sharing obligations. The measure (A.B. 2180) must be cleared by the Appropriations Committee in the coming weeks before advancing to the full Assembly. It must clear both chambers before the end of the state fiscal year on June 30th.

Similar legislation to ban these so-called “copay accumulators” is also moving forward in New Hampshire, where a committee vote is expected in early May. However, accumulator bills appear stalled for this year in Michigan, Missouri (despite passing the House), Rhode Island, and Vermont (also passed the House) and died earlier this year in Florida, Maryland, and Utah.

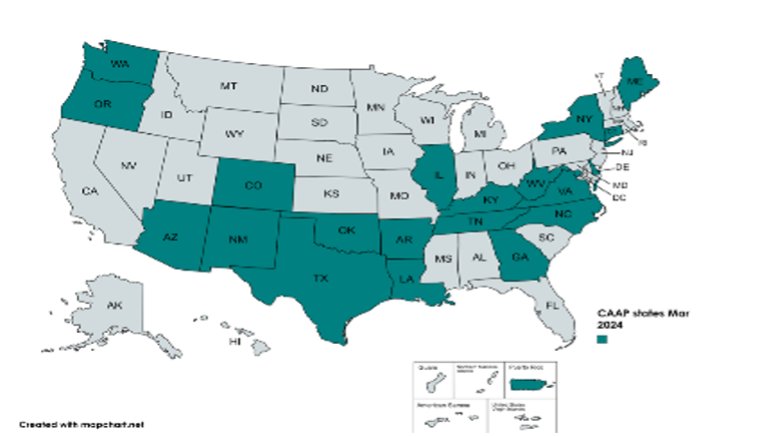

Oregon remains the one state that has enacted copay accumulator protections in 2024 (see State of the States, March 2024), bringing the overall total to 20 states (along with the District of Columbia and Puerto Rico).

Virginia governor blocks Prescription Drug Affordability Board

Governor Glenn Youngkin (R) vetoed legislation earlier this month that would have made Virginia the fifth state to create a Prescription Drug Affordability Board (PDAB), stating that giving the board power to impose “price controls” on drugs it deems unaffordable would have “unintended consequences” that would be “detrimental for patients with life-threatening diseases”. The veto of H.B. 570 was quickly sustained by the House.

Ten states have already implemented PDABs although they have taken very diverse approaches in how they are structured. PDABs in Massachusetts and New York focus on negotiating Medicaid supplemental rebates—several others merely make recommendations on cost limits. Only four states (Colorado, Maryland, Minnesota, and Washington) have the authority proposed in Virginia to set upper payment limits for drugs deemed unaffordable for consumers (Colorado was the first state to actually do so earlier this year).

Bills to create PDABs were considered in a dozen other states this session (and remain pending in at least Connecticut, Michigan, Pennsylvania, and Wisconsin).